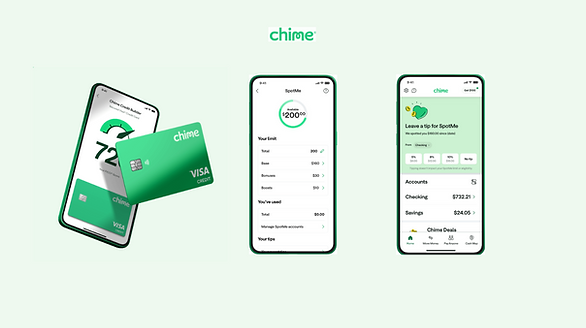

Chime

Banking services provided by bank partners with No monthly fees and 60k+ ATMs.

Chris Britt

Chime

Founder& CEO

201-500

United States

Financial Services

Scale-Up Stage Startup

Partnership Programs :

Target Location :

Worldwide

Empowering Financial Progress Through Partnership

Chime is a financial technology company dedicated to helping its members achieve financial peace of mind. By offering fee-free banking services, early direct deposit, and user-friendly mobile banking solutions, Chime simplifies money management for millions of Americans. Through its Affiliate Partner Program, Chime collaborates with content creators and marketers to promote its mission of financial empowerment.

Why Partner with Chime?

Chime's Affiliate Partner Program provides an opportunity for individuals and businesses to earn commissions by promoting Chime's financial services. Affiliates can leverage Chime's trusted brand, innovative banking solutions, and comprehensive marketing resources to drive conversions and earn rewards.

Chime in Numbers and Data

- #1 Most Loved Banking App

- Over 1 million 5 Stars reviews on Apple App & Google Play Store.

- Increase your credit scores an average of 30 pts with on-time payments.

- 50,000+ fee-free ATMs.

- 3.75% APY10 on a high-yield savings account.

- Up to $5003 of your pay before payday.

- Up to $2002 fee-free overdraft coverage.

- Chime has committed 1% of its equity to fund the Chime Scholars Foundation, Chime’s non-profit organization and is committed to providing financial education to over 10 million people by 2027.

What's in it for You?

Chime offers a single, robust partner program designed to help you earn commissions and grow with Chime by promoting their services to individuals seeking modern banking solutions.

Chime Affiliate Partner Program

For content creators, bloggers, and marketers aiming to monetize their platforms by promoting Chime's services. Affiliates earn commissions for each new customer who opens a Chime account through their referral link. The program provides access to marketing materials, real-time analytics, and dedicated support to optimize your promotional efforts.

Why Should You Collaborate with Chime?

Collaborating with Chime means partnering with a company committed to financial inclusion and innovation. Affiliates benefit from promoting a well-established brand known for its customer-centric approach and transparent banking solutions. By joining the Chime Affiliate Partner Program, you can contribute to a financial movement that prioritizes accessibility and simplicity.

Ready to Collaborate?

Explore Chime’s Affiliate Partner Program and start earning commissions by promoting a leading financial technology company.

Get started with Chime today!

Blogs

Free

Affiliate Partner

Consumers, Tech-savvy individuals

Voucher Name

$ 0

category

Get Free

Start date ~ End date

Voucher Name

$ 0

Get Free

Get Free

Start date ~ End date

Voucher Name

$ 0

Get Free

Get Free

Start date ~ End date

Similar Companies

Collapsible text is great for longer section titles and descriptions. It gives people access to all the info they need, while keeping your layout clean. Link your text to anything, or set your text box to expand on click. Write your text here...

..

by

Financial Service

>1000

United Kingdom